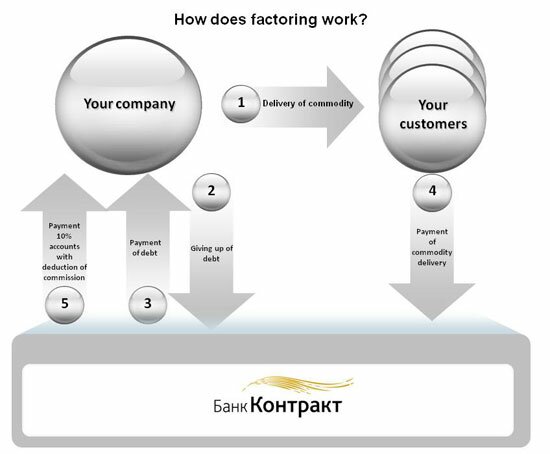

Factoring is a good opportunity for the supplier to get money very quickly for dispatched goods or delivered services and, hereby, plan own cash flow without waiting for the buyer’s payment.

The main factoring conditions in the bank “Kontrakt” are the following:

- Financing at the level of 90% of the volume of delivered goods/ services.

- Accounts receivable financing with deferred payment of up to 180 days.

- Pricing based on the interest rate of 26% per annum expressed in the fee of the amount of invoices provided for factoring.

- One-time fee for project review – from 1% (it shall be paid upon the conclusion of the factoring agreement).

- Providing the preliminary offer on financing that states all key parameters within three days (based on the short list of documents).

Boost Your income from business growth!

With additional financing You get a possibility to expand the range of goods, increase supplies, attract new customers and, consequently, increase turnover and revenue.

Get financing in good time!

Bring invoices for factoring and get funding in the day when You need it!

Enjoy financing without pledge!

Factoring service doesn’t envisage any pledge that gives You a new credit facilities and reduces a transaction processing cost (there are no fees for notary services, independent assessment, insurance).

Make Your business predictable!

Using factoring services of the bank “Kontrakt”, You are able to accurately predict and manage Your costs by submitting the invoices for factoring at necessary time.

Overdraft protection provided by Kontrakt Bank is a convenient and simple tool for your business.

Kontrakt Bank offers overdraft protection in situations where clients need funds for ongoing operations in excess of the balance on the current account.

The basic overdraft protection terms at Kontrakt Bank are the following:

- Up to 30% of monthly average turnover without collateral.

- Up to 100% of monthly average turnover against collateral (various options for collateral can be considered).

- No need to reset monthly.

- Interest rate on overdrafts – from 20% per annum (determined individually: depends on the characteristics of the borrower’s business and collateral).

- Fee for consideration of the project – 1% of the established credit limit (lump sum is charged).

- Fee for debiting the account – 0.005% of the amount.

- Loan term – 12 months, overdraft limit is reviewed on a monthly basis.

- Overdraft credit is granted subject to clearance of guarantee of the owner or top manager.

Within three days after the client has filed brief documentation, we provide the client with a preliminary proposal with the terms of overdraft protection.

Contact:

Division of Customer Relations

ph.: e-mail: